Engage

Personalized Guidance for the Financial Customer Journey

Engage

Personalized Guidance for the Financial Customer Journey

Customer expectations from their banking providers in the digital age go beyond just access to data and ease of use. Customers want their bank to proactively offer insight and advice that can help them achieve their financial goals. Personetics Engage is a new breed of banking solution, one that truly puts customer needs first. It provides timely and useful insights that keep customers informed and help them stay on top of their financial affairs. Using real-time predictive analytics to empower customers, banks can reestablish themselves as trusted partners to the consumer.

HOW BANKS USE PREDICTIVE ANALYTICS TO EMPOWER CUSTOMERS

Educate customers about savings and long-term financial wellness

Suggest specific steps to increase savings, reduce debt, and improve financials outcomes

Initiate automated actions to help the customer stick with the plan and meet financial objectives

Provide ongoing feedback and realign actions with goals

Engage in Action

How it works

The Right Information for Each Customer at the Right Time

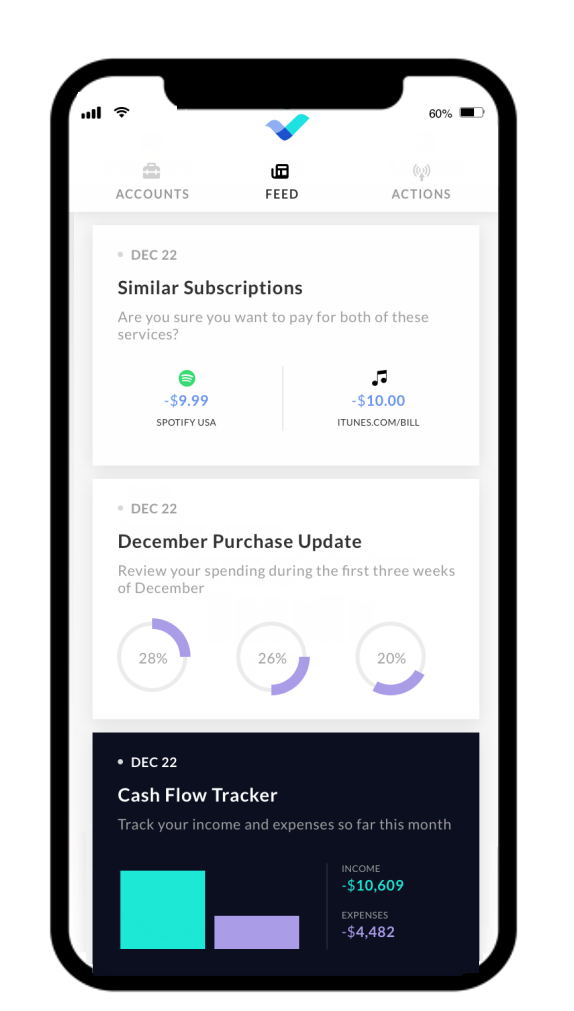

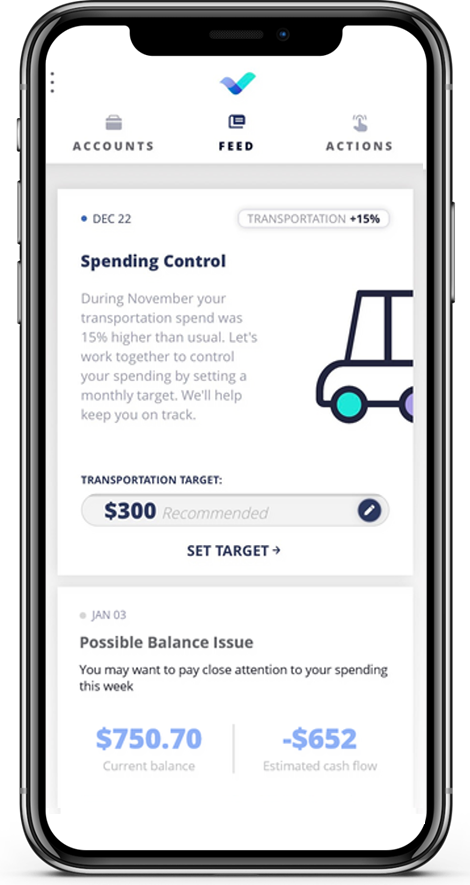

Engage analyzes user-specific data streams to create a personalized list of actionable insights. To determine the optimal prioritization and display order for each user, we utilize a proprietary learning algorithm that identifies and ranks the most relevant insights at any point in time.

Real-Time Insights

Insights are triggered upon invocation, to ensure they account for the most recent customer activity and reduce false positives. For example, alerting a customer to a low balance issue based on previous night’s batch feed would be inaccurate if the customer had a cleared deposit earlier in the day.

Out-of-the-Box User Insights for Financial Services

Engage comes with a rich library of pre-built user scenarios that include banking-specific triggers and workflows validated with banking customers across the globe, with new insights added on an ongoing basis.

Self-Learning

Over time, Engage learns from individual customer interactions to better select and prioritize insights for each customer. It also supports the ability to capture explicit user feedback (rating, likes, etc.) that is utilized as part of the learning algorithm.

Controlled by the Bank

The Engagement Builder allows business users to manage pre-built insights and create new ones using the Personetics framework.

Results

Increase Engagement, Satisfaction, and Response. Using Engage, banks are able to:

Increase

customer engagement by providing contextually-relevant insight and advice

Offer

products and services which anticipate and meet customer needs

Jumpstart

customer adoption from day one – no data entry or setup needed

Seamlessly adapt

to user preferences while retaining the ultimate control

Accelerate

time-to-market with pre-packaged financial services knowledge

90%

Average satisfaction rate with content offered

15-30%

Response rate to recommendation by engage

30-40%

Average customer engagement rate

Want to explore how your bank can harness the power of AI to engage and serve customers?

We work with banks of all sizes across all geographies and will be happy to see how we can help.

New York

London

Tel Aviv

Singapore

Tokyo