- Homepage

- Products

- About us

- Solutions

- Resources

- Resources Hub

- Type

- Blog

- Customer Stories

- eBooks

- Events

- Webinars

- Reports

- Podcasts

- Videos

- Press Releases

- Business needs

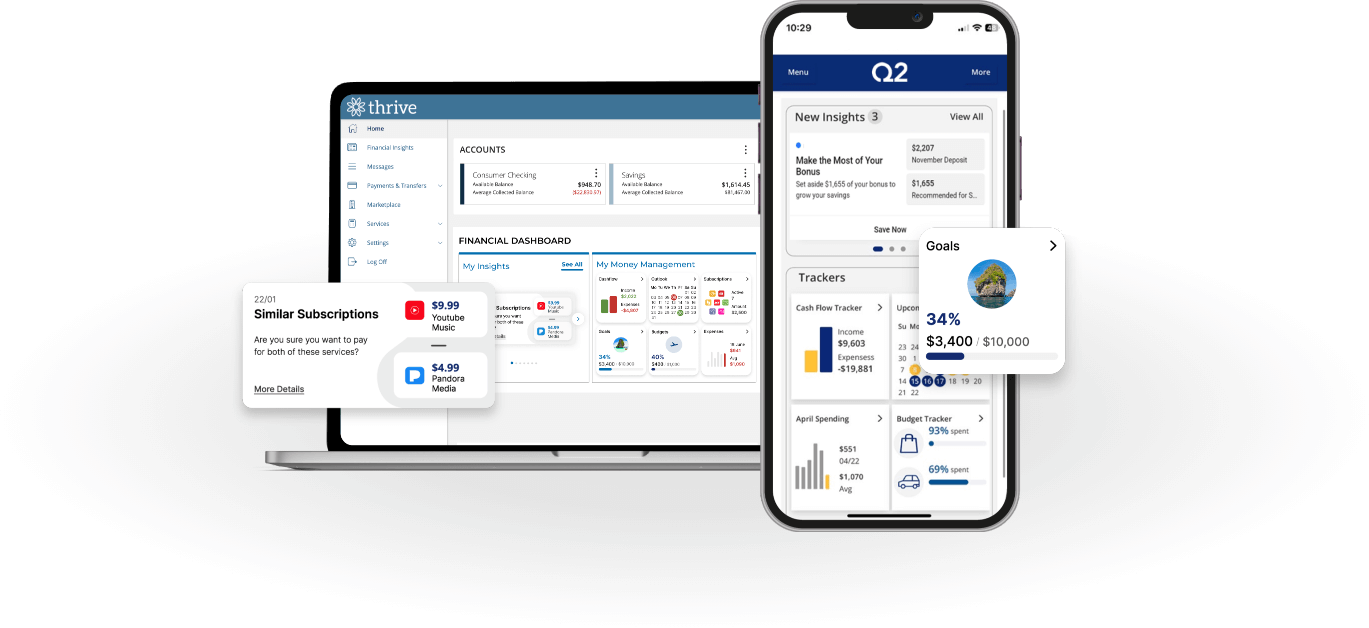

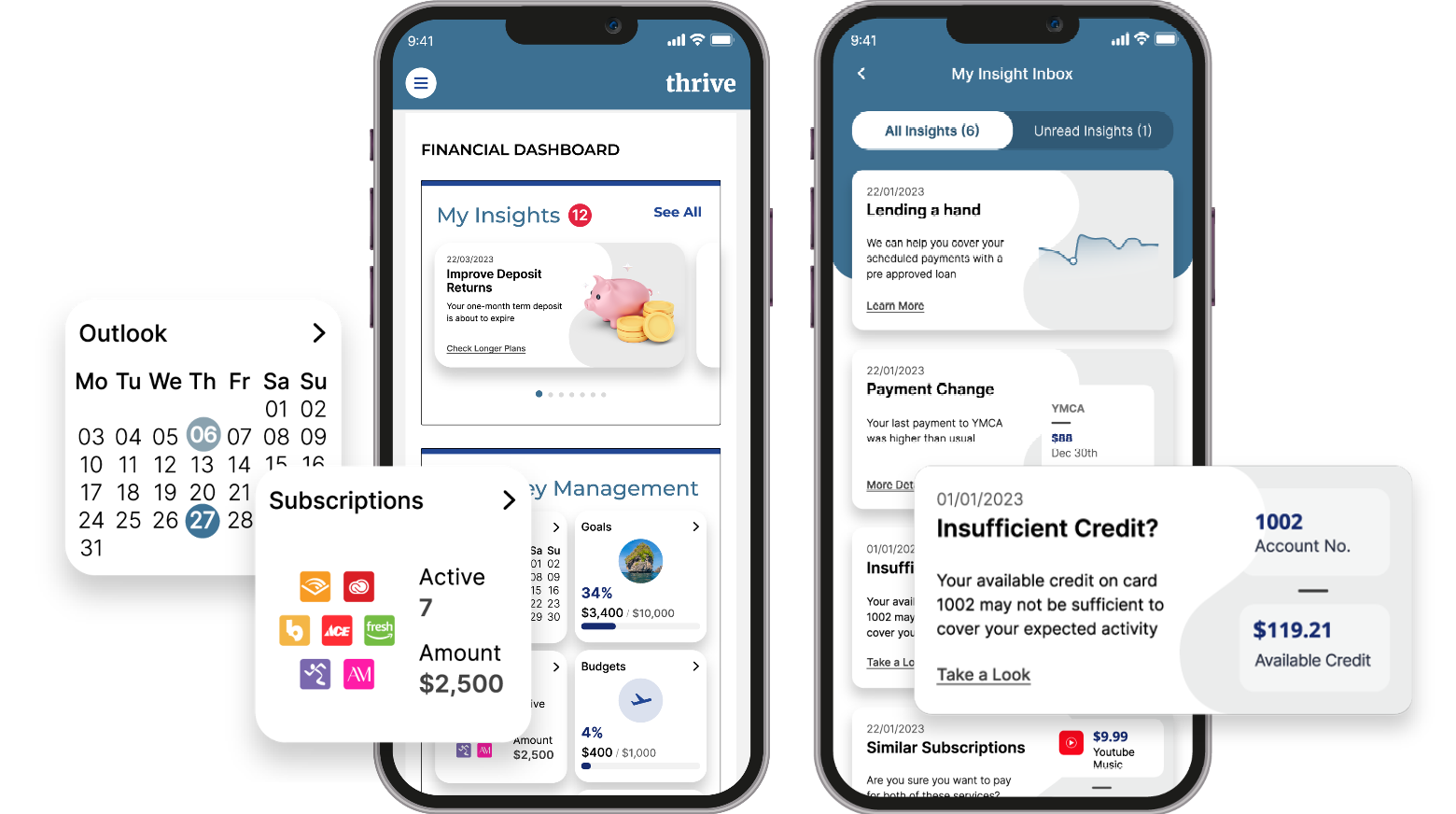

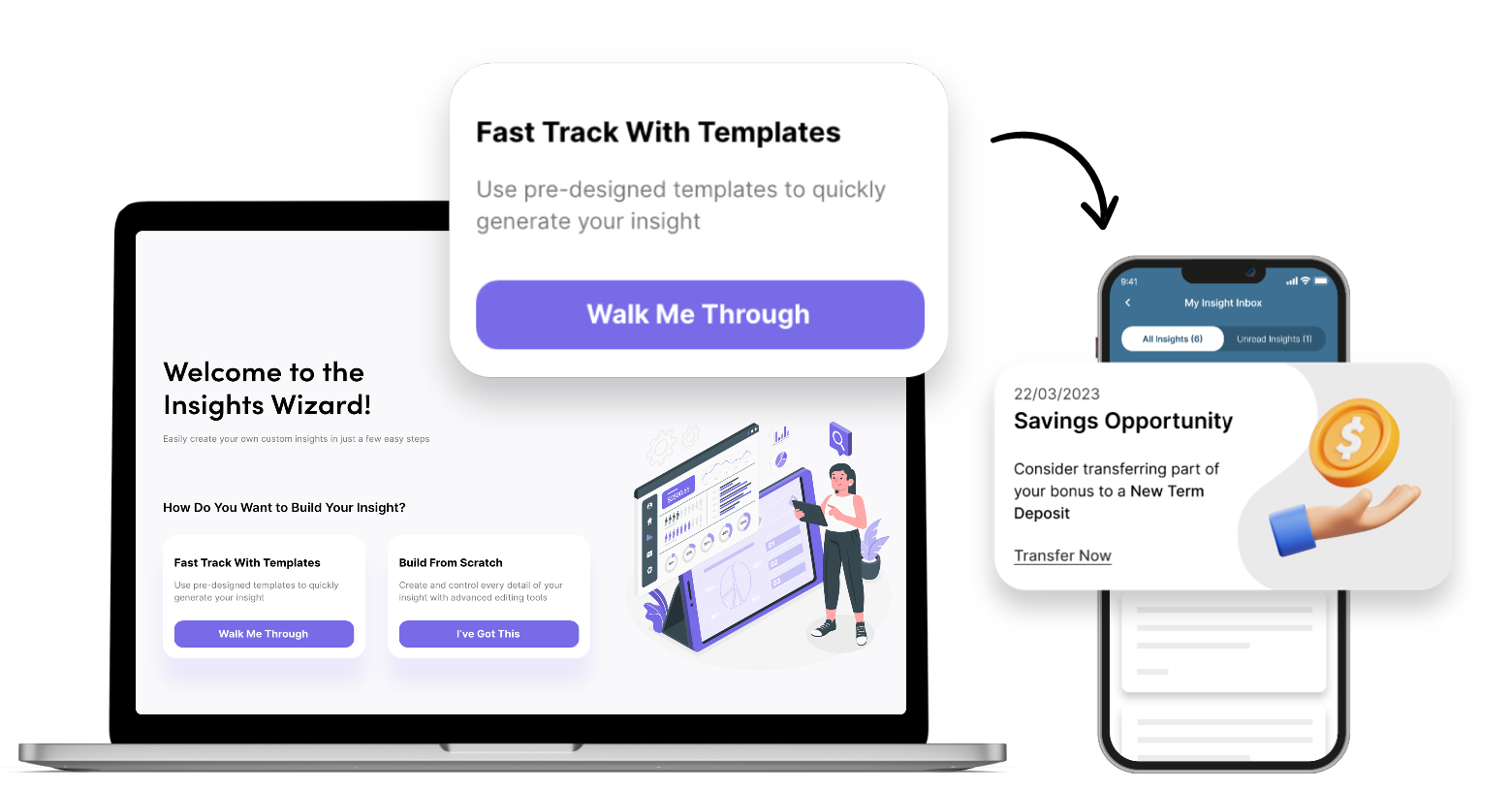

- AI-Powered Banking

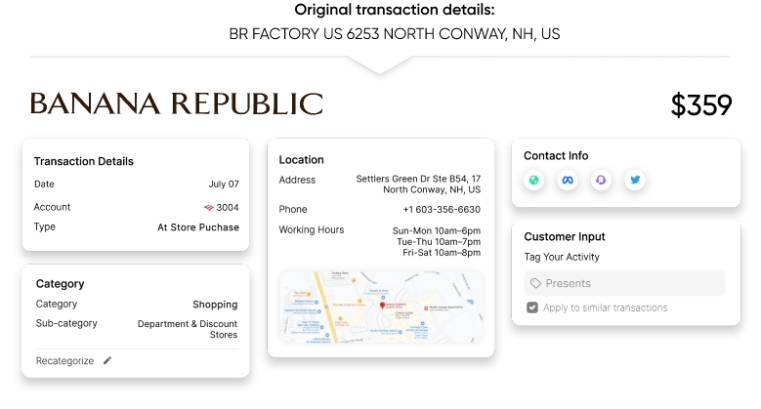

- Categorize and Enrich Transaction Data

- Deliver Value beyond Traditional PFM

- Increase Customer Engagement and Sales

- Improve Customers financial well-being

- Win, Grow and Retain Deposits

- SMB/SME Banking

- Reduce Customers Carbon Emission

- News